Reinsurance Solutions for Dealers

Build wealth, increase control, and turn F&I “expenses” into dealer-owned assets—without adding busywork for your store.

Reinsurance Solutions for Dealers

Build wealth, increase control, and turn F&I “expenses” into dealer-owned assets—without adding busywork for your store.

Why Reinsurance with Capital Management Group?

Most providers control the cash, the cadence, and the decisions. We take the opposite approach: put the dealer in control—ownership, transparency, and predictable funding—so your reinsurance company becomes a reliable profit engine, not a black box.

What changes when you own it:

100% ownership & profits. You own the company and keep underwriting profit and investment income.

Transparent fees & clean documentation. Full disclosure up front; plain-English agreements.

Prompt, consistent funding. Premiums ceded weekly; no “float” games.

Dealer involvement where it matters. Objective claims administration with the ability to participate in critical decisions.

How It Works (at a glance)

Enroll F&I products (VSC, appearance, tire & wheel, PPM, etc.).

Cede premium weekly to your reinsurance account.

Claims administered by a third party; net-net remit reduces cash drag.

Invest reserves per your guidelines; access capital via documented loans.

Quarterly cession reviews to optimize rates, loss ratio, and profit.

What You Get with CMG Reinsurance

Quarterly, in-person analysis of production, paid claims, and loss ratios.

Net-net remit (apply approved claims/cancellations against current month business).

No long-term writing commitment; no large upfront capitalization.

Access to capital via no-fee loans from earned (and a portion of unearned) premiums; your company earns the interest.

Dealer retention mechanics like service tiebacks to bring customers back to your shop.

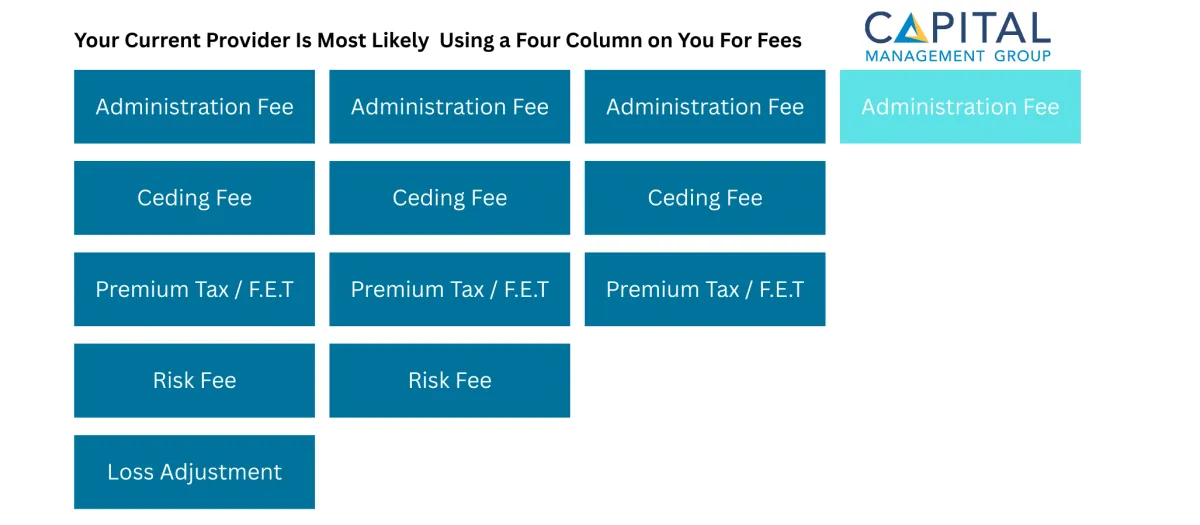

Transparency in Every Dollar

See exactly where your money goes — and how much more stays with you when you use CMG.

Product Lines You Can Reinsure

Vehicle Service Contracts

Lifetime Powertrain warranties

Lease & GAP Coverage

Custom CPO/PPM

Appearance protection

Tire & Wheel Protection

Key Replacement

Prepaid Maintenance

Theft & recovery, and more

Products are flexible in terms, coverage, and eligibility, including EV support.

Proof & Performance

Weekly funding + quarterly reporting provide measurable accountability.

Industry recognition: the referenced program has been ranked a top reinsurance provider in every Dealers’ Choice Awards survey since 2008; two IRS TAMs validate program structure.

Historical outcomes & projection methodology are based on long-run data across market cycles (not short-term samples).

(We’ll tailor projections to your actual deal counts, gross, and loss history during your cession review.)

Reinsurance vs. “Traditional” Profit Participation

With CMG’s approach:

You own the company and the upside (underwriting + investments).

You get weekly premium cessions and transparent, quarterly reporting.

You retain control over rates/terms (within guidelines) and keep documentation clean.

Explore Our Other Services

FAQS

What makes Capital Management Group’s F&I Training different from other providers?

Unlike generic training programs, Capital Management Group’s F&I Performance Training is tailored specifically for your dealership’s needs. Our trainers are experienced automotive professionals who work directly with your team to improve presentation, compliance, and profitability—delivering real-world results, not just theory.

Can you help us design a custom F&I menu for our dealership?

Absolutely. We specialize in Custom Menu Design that aligns with your dealership’s unique products, sales process, and compliance standards. Our menus are easy for customers to understand and help increase product penetration without high-pressure tactics.

Do you offer ongoing support after initial consulting?

Yes. Capital Management Group offers continued support through regular reporting, compliance checks, and strategy reviews. Our goal is to become a long-term partner—not just a one-time consultant—so your dealership stays ahead of industry changes and maintains high performance.

Explore Dealer-Owned Reinsurance with CMG

Schedule a confidential strategy session. We’ll review your F&I mix, loss ratios, projected cessions, and cash-flow scenarios, then deliver a straightforward build-out plan and timeline.

Capital Management Group